Background

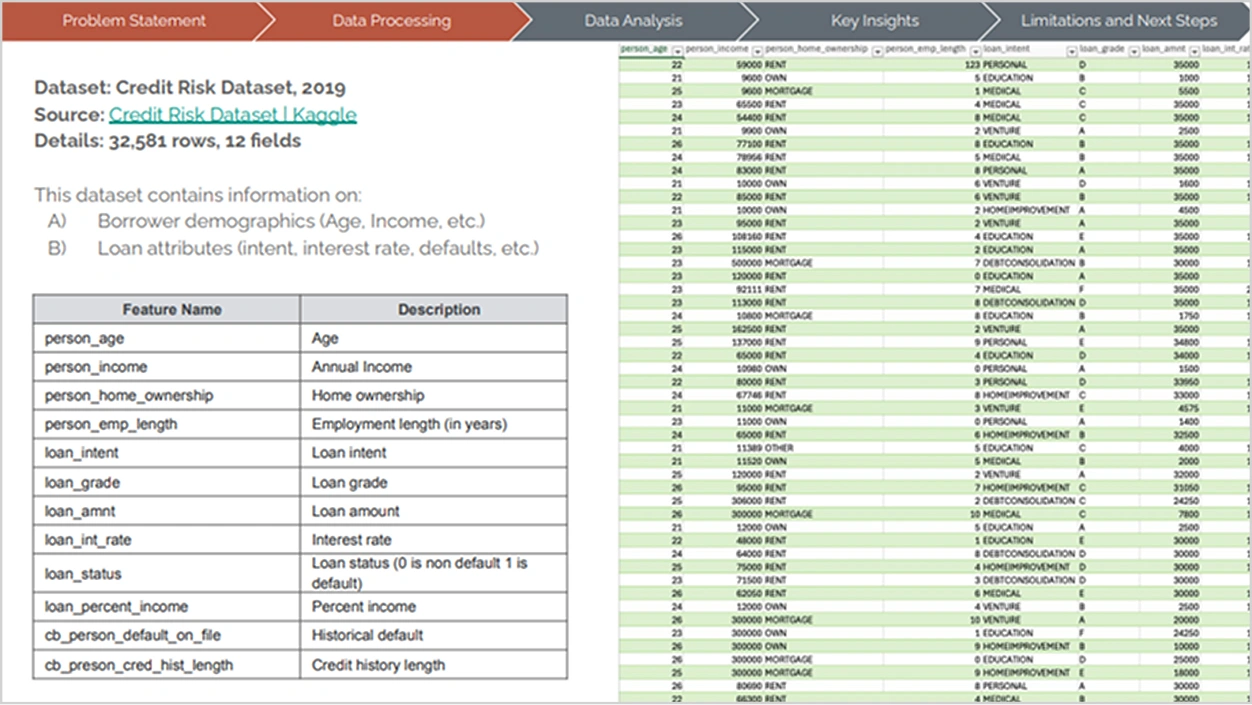

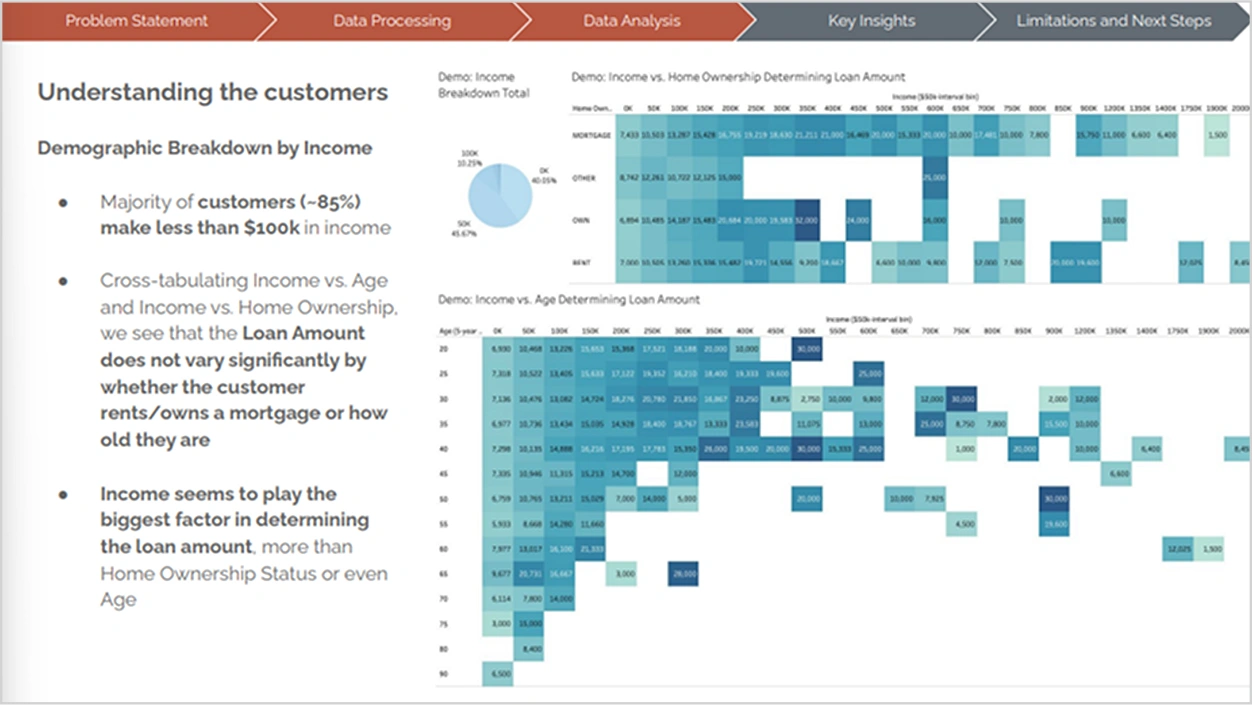

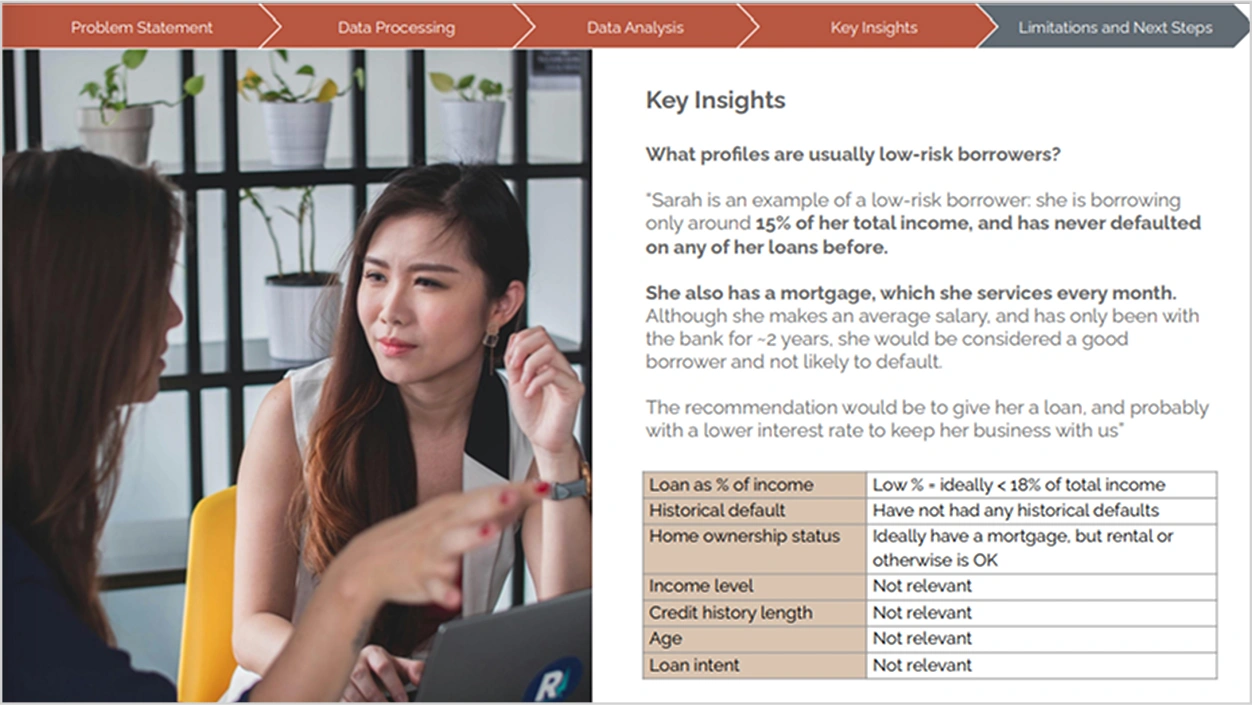

The “Loan Risk Analytics” project analyzed borrower data to identify default patterns and reduce financial risk. Using a dataset of 32,581 records, I applied data analysis techniques to uncover key risk factors like loan-to-income ratios and historical defaults, guiding better lending decisions for DMS Bank.

The goal of the “Loan Risk Analytics” project is to develop a data-driven model that helps DMS Bank predict high-risk borrowers more accurately. By analyzing borrower demographics, loan details, and default patterns, the project aims to reduce loan defaults, improve lending decisions, and optimize the bank’s risk management strategies.

Why Learn Advanced Data Analytics

With businesses becoming increasingly data-driven, data analytics skills are highly sought after in Singapore’s competitive job market. Companies across industries rely on data analysts to make informed decisions, identify trends, and uncover opportunities.

The field of data analytics offers a unique blend of technical proficiency and strategic thinking. You’ll master tools like Excel, Tableau, and SQL, and apply them to solve complex problems using data. Analyze, visualize, and communicate insights that drive impactful business outcomes.

Enter the data industry with Vertical Institute’s beginner-friendly Data Analytics Bootcamp. Graduate with an IBF-accredited certification and a portfolio-ready capstone project that highlights your data analysis expertise.

Are There Government Subsidies Available?

Singaporeans and PRs can receive up to 70% IBF Subsidy off their course fees with Vertical Institute. The remaining fees can be fully claimable with SkillsFuture Credits. NTUC Union members may also utilise UTAP Funding to offset 50% of remaining fees.

Learn more about our Advanced Data Analytics course today.