Background

A bank manager is concerned about a growing trend of customers discontinuing their credit card services. They would like to gain insights into customer profiles and segments that are at risk of churning. This study is to take proactive measure customers churn, enhancing the bank services and churn prevention to keep customers.

Why Learn Data Analytics

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. t has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Are There Government Subsidies Available?

Singaporeans and PRs can receive up to 70% IBF Subsidy off their course fees with Vertical Institute. The remaining fees can be fully claimable with SkillsFuture Credits. NTUC Union members may also utilise UTAP Funding to offset 50% of remaining fees.

Learn more about our Data Analytics course today.

Related Topics:

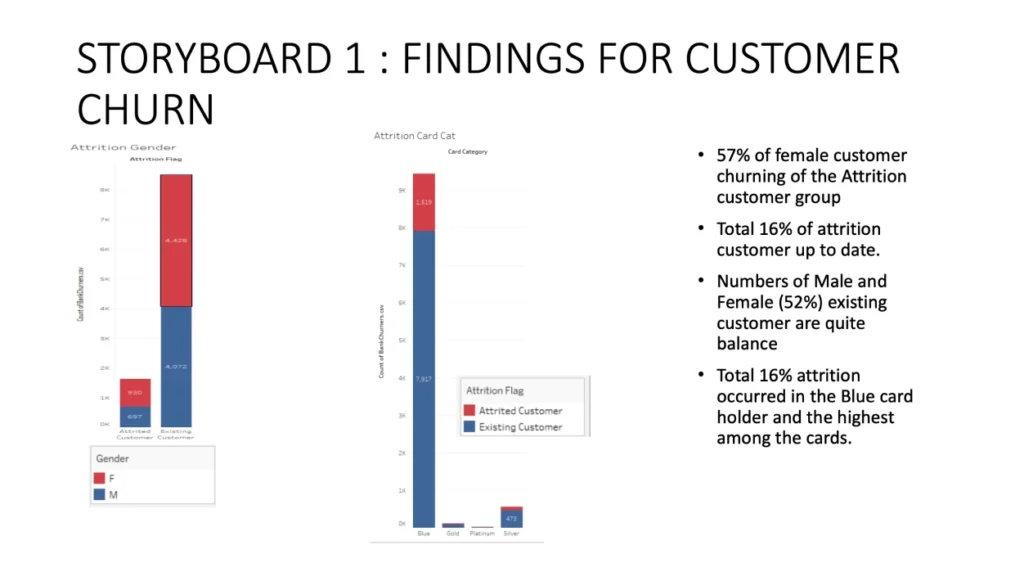

Customer Profile Exploration and Analysis

Security Risk and Recommendation